DISCLOSURES:

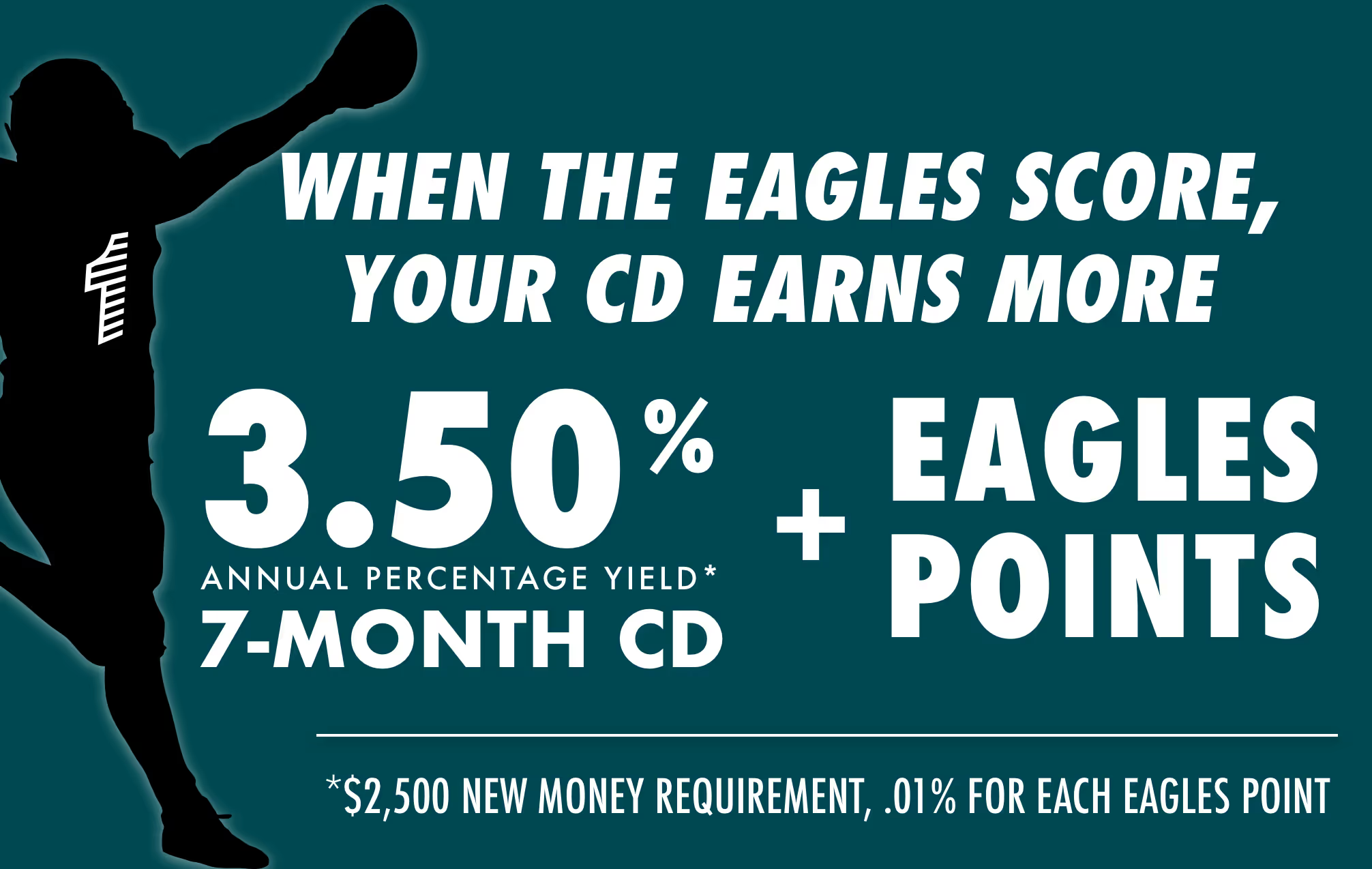

* The 7-Month Touchdown CD will earn the initial Annual Percentage Yield (APY) from the date the CD is opened and funded through the date of the next Regular Season or Post Season game played during the 2025/2026 season. The APY for the 7-Month Touchdown CD will increase in basis points by the number of points the Eagles score in the first game played after the 7-Month Touchdown CD is opened (a basis point is equal to .01%). The increase, if any, will be effective on the first Firstrust Bank business day following that game and the new APY will be effective until the first maturity date. The 7-Month Touchdown CD is only eligible for a one-time basis point increase; the 7-Month Touchdown CD does not accumulate basis points for any other 2025/2026 season games. A new 7-Month Touchdown CD must be opened prior to each game at the initial yield to earn basis points for that game. For example, if you open a 7-Month Touchdown CD today, your APY will start at 3.50% and if the Eagles score 35 points in their next game after you fund the 7-Month Touchdown CD, your APY is 3.50% plus 0.35% for a total of 3.85%. May not be combined with any other offer. See the 7-Month Touchdown CD Addendum for complete details.

This is a limited time offer. Initial APY on the 7-Month Touchdown CD is subject to availability and the offer may change or be withdrawn at any time and without notice at the bank’s discretion. The minimum deposit to open the account and obtain the APY is $2,500. $2,500 minimum deposit of new funds required. New funds are funds not currently on deposit at Firstrust Bank or invested through Firstrust Financial Resources. The maximum opening deposit for this 7-Month Touchdown CD is $500,000. All other terms and conditions of the 7-Month Touchdown CD, including compounding of interest, are the same as Firstrust Bank’s CDs as defined in the current Truth in Savings Disclosure. The APY may change after the account is opened. Eligible for Regular CDs and Traditional, Roth and SEP IRAs. There is a penalty for early withdrawal. Fees may reduce earnings on the account. Additional federal penalties may apply for IRA CD with drawals below age 59 1/2. (Please consult your tax advisor.) APY is accurate as of 11.10.2025. Available in PA/NJ/DE only.