† DISCLOSURES:

Home Equity loans and lines of credit are offered by Firstrust Bank NMLS # 424205. Firstrust National Mortgage Licensing Service (NMLS) Representatives

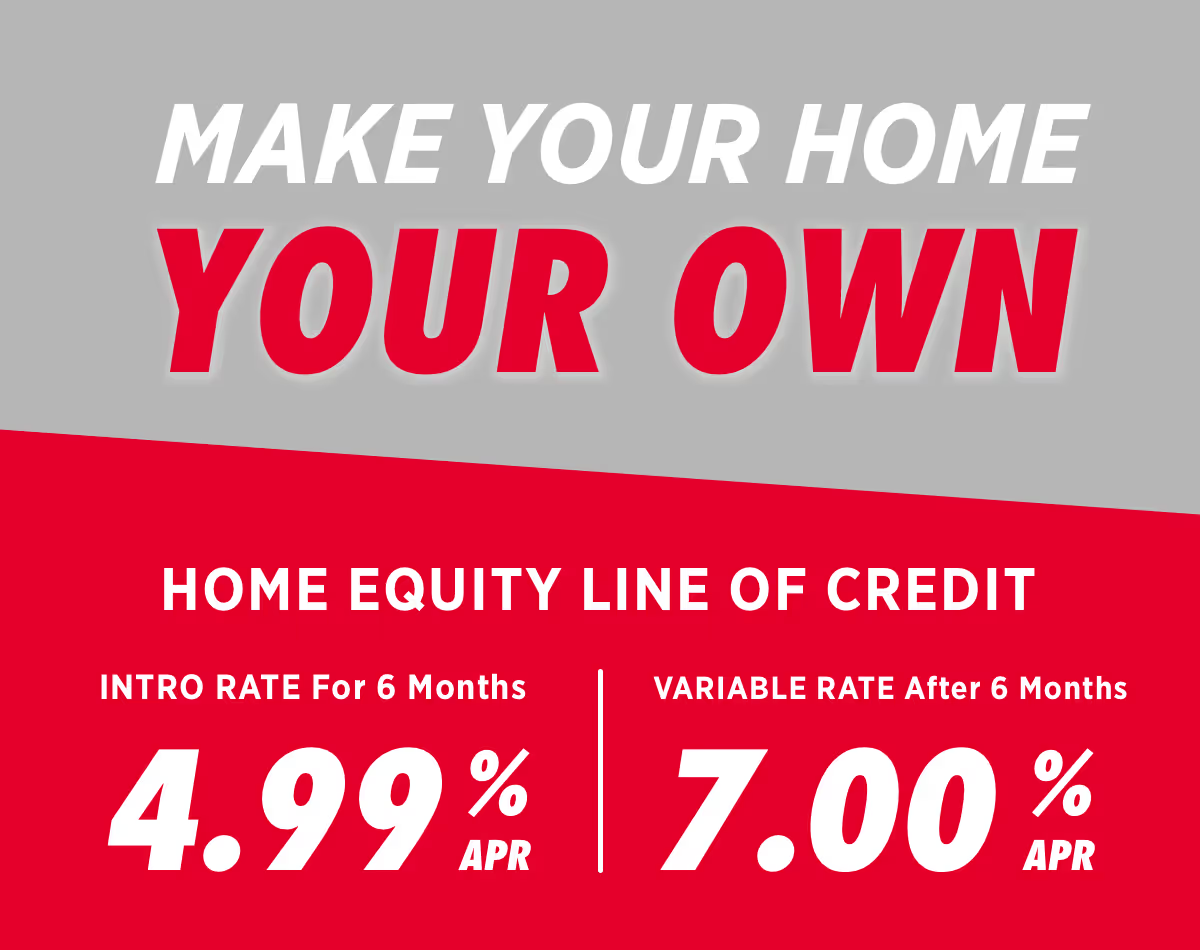

Home Equity Line of Credit Annual Percentage Rates (APR’s) offered are subject to change at any time and without notice. Applicants subject to credit approval. Lines of credit secured by an interest in your real estate, property insurance required. Title insurance required on lines over $400,000 with a maximum credit line of $500,000 and is estimated to range in cost from $2,600 to $3,100. Monthly payments required when there is a balance. The maximum loan-to-value ratio is 80%. The introductory APR today is 4.99% for the first 6 months. After expiration of the 6-month introductory rate period, the APR today is 7.00% which is equal to the highest U.S. Prime Rate in the Wall Street Journal + 0%, this is a variable rate which may increase. Maximum APR is 25% and the minimum APR after the introductory period is 3.25%. A $30 annual fee is waived the first year. A $250 fee applies for lines closed within twelve months of opening.

5 Year - 7.49% Annual Percentage Rate (APR) shown is subject to change at any time and without notice. All loan applications are subject to individual approval. Property insurance will be required. Title insurance is required on loans over $400,000 up to the maximum loan amount $500,000 and is estimated to range in cost from $2,600 to $3,100. APR for entire amount borrowed. Other terms and conditions apply. If the loan is secured by a first lien on a dwelling, payments do not include amounts for taxes and insurance premiums and the actual payments will be greater. A $10,000 Home Equity Loan at 7.49% would equal an APR of 7.49% with 60 monthly payments of $200.33.

5 Year - 6.24% Annual Percentage Rate (APR) shown is subject to change at any time and without notice. All loan applications are subject to individual approval. Property insurance will be required. Title insurance is required on loans over $400,000 up to the maximum loan amount $500,000 and is estimated to range in cost from $2,600 to $3,100. APR for entire amount borrowed. Other terms and conditions apply. If the loan is secured by a first lien on a dwelling, payments do not include amounts for taxes and insurance premiums and the actual payments will be greater. A $50,000 Home Equity Loan at 6.24% would equal an APR of 6.24% with 60 monthly payments of $972.23.

10 Year- 7.74% Annual Percentage Rate (APR) shown is subject to change at any time and without notice. All loan applications are subject to individual approval. Property insurance will be required. Title insurance is required on loans over $400,000 up to the maximum loan amount $500,000 and is estimated to range in cost from $2,600 to $3,100. APR for entire amount borrowed. Other terms and conditions apply. If the loan is secured by a first lien on a dwelling, payments do not include amounts for taxes and insurance premiums and the actual payments will be greater. A $10,000 Home Equity Loan at 7.74% would equal an APR of 7.74% with 120 monthly payments of $119.96.

10 Year- 7.24% Annual Percentage Rate (APR) shown is subject to change at any time and without notice. All loan applications are subject to individual approval. Property insurance will be required. Title insurance is required on loans over $400,000 up to the maximum loan amount $500,000 and is estimated to range in cost from $2,600 to $3,100. APR for entire amount borrowed. Other terms and conditions apply. If the loan is secured by a first lien on a dwelling, payments do not include amounts for taxes and insurance premiums and the actual payments will be greater. A $50,000 Home Equity Loan at 7.24% would equal an APR of 7.24% with 120 monthly payments of $586.75.

15 Year - 7.74% Annual Percentage Rate (APR) shown is subject to change at any time and without notice. All loan applications are subject to individual approval. Property insurance will be required. Title insurance is required on loans over $400,000 up to the maximum loan amount $500,000 and is estimated to range in cost from $2,600 to $3,100. APR for entire amount borrowed. Other terms and conditions apply. If the loan is secured by a first lien on a dwelling, payments do not include amounts for taxes and insurance premiums and the actual payments will be greater. A $10,000 Home Equity Loan at 7.74% would equal an APR of 7.74% with 180 monthly payments of $94.07.

15 Year - 7.24% Annual Percentage Rate (APR) shown is subject to change at any time and without notice. All loan applications are subject to individual approval. Property insurance will be required. Title insurance is required on loans over $400,000 up to the maximum loan amount $500,000 and is estimated to range in cost from $2,600 to $3,100. APR for entire amount borrowed. Other terms and conditions apply. If the loan is secured by a first lien on a dwelling, payments do not include amounts for taxes and insurance premiums and the actual payments will be greater. A $50,000 Home Equity Loan at 7.24% would equal an APR of 7.24% with 180 monthly payments of $456.15.